The IRS bars IRA owners from holding life insurance coverage and collectibles—like artwork, antiques, and gems—in IRAs. And you can find Exclusive service fees that the custodial organization can charge for protecting the account.

Investigate extra homeownership resourcesManaging a mortgageRefinancing and equityHome improvementHome valueHome insurance coverage

Compliance with IRS regulations and strict avoidance of prohibited transactions are critical for self-directed IRA investors.

Examine additional personal mortgage resourcesPre-qualify for a private loanCompare top lendersPersonal mortgage reviewsPersonal mortgage calculatorHow to qualifyHow to consolidate bank card debtAverage own bank loan desire prices

In the event you’re seeking to create a “go wherever” self-directed IRA, you’ll should Get hold of a custodian who specializes in These types of buildings. Even the highest brokers for IRAs don’t typically offer you the chance to put money into alternative investments.

A large IRA ecosystem: Over $12 trillion is parked in IRAs across the nation. That’s a mountain of money just waiting around to get place to work! SDIRAs unlock this possible by enabling you to take a position these retirement funds in alternative assets to aid Increase your returns and diversify your sites nest egg.

Although some valuable metal IRA corporations may possibly seem clear with regard to the substantial supplemental costs and charges incurred by this kind of account, on The complete they charge selling prices that operate very well higher than the industry common for cherished metals.

To open up a self-directed IRA, the IRS involves you to experience a custodian who'll keep the account. Custodians of SDIRAs tend to be money establishments or believe in companies, as well as their purpose should be to ensure site here the account owners stick to IRA policies, including the yearly contribution limit and reporting on the IRS.

Forbes Advisor adheres to stringent editorial integrity standards. To the very best of our know-how, all content is accurate as in the day posted, even though delivers contained herein may possibly not be obtainable.

NerdWallet's content is fact-checked for accuracy, timeliness and relevance. It undergoes a thorough review system involving writers and editors to ensure the information is as crystal clear and complete as feasible.

Legacy planning: Use SDIRAs to make a tax-advantaged legacy to your family and friends or picked out charities.

Thinking about the diversification and standard balance of the price of gold, picking gold is a superb acquire option. The us maintains stocks of gold with the Fort Knox ingot deposit in gold bricks weighing 27.five pounds per unit.

Investigate extra auto bank loan resourcesBest car financial loans forever and poor creditBest navigate here automobile loans refinance loansBest lease buyout loans

As soon as you’ve found your custodian and dealer, you could instruct your custodian to buy your investments from the supplier.

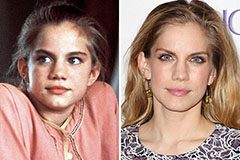

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Shane West Then & Now!

Shane West Then & Now!